Adult social care

2.1 Social care plays an essential role in supporting people to live the lives they want to lead. Before the COVID-19 pandemic this role was often invisible and a submission to a spending review would have had to champion the value of social care.

2.2 The pandemic has changed this. Social care, and crucially its value to people and wider society, is visible to all like never before. Daily media coverage has shown the public the extraordinary lengths the care workforce has gone to in keeping our loved ones safe and well, often sacrificing time with their own families to do so and always wary of the risks they are exposed to. Politicians from all parties have paid tribute to the workforce and the Government has stated that, as a nation, we are indebted to their selfless dedication.

2.3 In just a few short months, the pandemic has revealed to the public at large both the strengths and value of social care, and its many challenges.

2.4 Even before the pandemic, adult social care was under significant financial pressure.

- The squeeze on council budgets has resulted in some adult social care providers being in a perilous state. The IFS has estimated that the pressure on the provider market, resulting from councils paying less than a sustainable rate on commissioned services, is worth £1.34 billion on the basis of most recent data. Over time, if unaddressed this can grow to as high as £1.7 billion due to demand and inflation pressures. This is in line with our past analysis.

- LGA analysis before the pandemic showed that adult social care costs were projected to increase by £1.3 billion each year from 2019/20 to 2024/25 simply to maintain 2019/20 levels of access and quality, but factoring in demand and inflationary pressures, such as the NLW. This included demand pressures for both older and younger adult cohorts. IFS analysis suggests a similar estimate for annual cost pressures.

- Councils received 1.91 million requests for support from new clients in 2018/19, up from 1.84 million requests in 2017/18. Age UK estimates that there are 1.4 million older people who do not receive the help they need.

2.5 The legacy of COVID-19 for social care – and most importantly the people who use social care services – must therefore be a reset, not simply a restart.

2.6 This impetus should spur our thinking around long-term reform of care and support, which we have always said should be built on cross-party cooperation. We are committed to working with Government and all parts of the social care world – particularly those with lived experience – on a way forward that is informed by the many valuable lessons from the pandemic on the role and value of social care in all our lives.

2.7 The Comprehensive Spending Review provides a crucial opportunity to begin that process. It must act on three main fronts:

- provide additional funding to shore up social care ahead of winter and a likely second wave of the virus, with a look to this continuing in future years;

- provide additional funding for the medium term to help address the long-standing challenges that have faced social care, many of which have been exacerbated by the pandemic; and

- use the above funding as a ‘down-payment on reform’ and to pave the way for changes that will finally put the funding of social care on a sustainable footing for the long-term.

2.8 Councils, supported by the LGA, are uniquely placed to help bring about further improvements in adult social care. We have the relationships – both locally and nationally – with partners across health, housing, the voluntary and community sector (VCS) and providers, that are required to drive social care forward and deliver the changes we all know are needed. When councils have been funded to do things, such as commission additional services and implement rapid discharge arrangements to free up beds for COVID-19 patients, they have delivered.

2.9 Councils’ track record on delivery is a strong starting point for assuring the Government that any additional investment in social care will be well used. But we recognise and accept that significant increases in funding, such as we are calling for, would likely require even greater assurance that funding was being used in the right way. Additionally, the experience of the pandemic has highlighted some of the challenges involved in securing effective national oversight of what is an inherently local public service. The LGA is committed to working with the Government to consider how best to develop a clearer national ‘line of sight’ that still remains compatible with the principles of localism and sector-led improvement. The Care Act achieves this in legislative terms, providing a national legal framework for care and support that is locally delivered and expressed. Now is the time to develop a comparable arrangement for oversight.

Bolstering adult social care’s immediate resilience

2.10 The experience of the last few months has demonstrated, without question, that social care will need additional investment to ensure its resilience heading into winter and a potential second wave of the virus. Only by providing social care with the funding that it needs can continuity be secured for older and disabled people and their family and friends providing unpaid care. Of critical importance is ensuring the provider sector is financially resilient.

2.11 Amidst considerable pressures, councils have worked tirelessly – both before and during the pandemic – to maximise all available funding to best shape, commission and deliver services in such a way that supports people to live the lives they want to lead. This work also continues to help reduce pressure on the NHS and councils’ efforts in recent years should be seen as a foundation for future activity that is centred on supporting people of all ages and with a range of different conditions to live their best lives.

2.12 Since the outbreak of COVID-19, the LGA and national provider bodies have worked closely and constructively together to understand the additional costs facing providers as a result of the pandemic and how best to mitigate them. It is clear that councils are prioritising adult social care in respect of the emergency funding that has been made available to them, with nearly 40 per cent of the funding used for this purpose.

2.13 However, it is important to note that £4.3 billion of funding provided by Government so far, to tackle the cost impact of COVID-19, is intended to cover all council service areas. In addition, this is insufficient in comparison to the overall projected £5 billion COVID-19 cost pressure reported by councils for 2020/21, before even considering lost income.

2.14 The Government has already announced an extra £300 million for the NHS to help prepare for upcoming winter pressures. It is vital that adult social care is also supported. The extension of the Infection Control Fund through winter with an additional £546 million and the Government’s commitment to supply care homes with PPE at no cost are therefore very welcome.

2.15 However, the challenges facing adult social care in the short-term extend beyond infection control. It is essential that funding at this critical time is therefore kept under close review.

Tackling pre-pandemic challenges over the medium term

2.16 While there are many excellent and innovative examples of good practice, the fact that funding available to councils has not kept pace with demand has inevitably curtailed councils’ ability to extend their reach. Consequently, investment in preventative services remains low, the provider market remains fragile, the workforce faces significant recruitment and retention challenges and unmet and under-met need remains a serious issue.

2.17 While much of the media focus on social care during the pandemic has understandably been on older people, it is essential to remember that the number of working age adults requiring support is just as important. In 2018/19, requests for support for working age adults rose by more than 70,000 from 2017/18 to 1.9 million. There was a bigger percentage increase in requests from working age adults (5.1 per cent) from the previous year compared to requests from older people (3.3 per cent). The Association of Directors of Adult Social Services (ADASS) budget survey from 2019 also shows that services for working age adults account for 58 per cent of the demographic pressures on social care budgets, compared to 42 per cent for older people.

2.18 Addressing medium-term pressures on adult social care by meeting the funding gap facing councils, as set out in Chapter 1 of our submission, would help manage consequences of the fragile state of funding for adult social care already seen prior to the pandemic:

- Quality: the latest Care Quality Commission’s (CQC) annual ‘State of Care’ report shows that quality levels in adult social care have been maintained, with 84 per cent of services rated either ‘good’ or ‘outstanding’ (up from 82 per cent last year). However, the report also highlights that access to services is challenging. For instance, some people eligible for homecare have struggled to access support because of a lack of services or a long waiting time.

- Workforce: the aforementioned CQC report also highlights concerns with the social care workforce, with care workers reporting 'chaotic and unorganised shift patterns, at times without breaks, causing many to feel dissatisfied, stressed and undervalued'. If the workforce grows proportionally to the number of people aged 75 and over in the population, then a 50 per cent increase (800,000 new jobs) will be required by 2035. Adult social care pay and conditions are discussed in more detail in the ‘Specific and specialist adult social care issues’ section below.

- Unpaid carers: research by Carers UK shows that carers who care for more than 50 hours a week report poorer health. One in four report bad or very bad physical health and 29 per cent report bad or very bad mental health. Eighty one per cent of all carers report feeling lonely and isolated as a result of their caring role. There is emerging evidence that COVID-19 has exacerbated this, with carers being more reluctant to admit care workers into their homes and with informal services, such as day services, not being available. Young carers encounter particular challenges – for example, they have significantly lower levels of attainment at GCSE level and are more likely to not be in education, employment or training.

- Providers: last year’s ADASS budget survey showed that 75 per cent of councils (up from 66 per cent last year), reported that providers in their area had closed, ceased trading or handed back publicly-funded contracts in the last six months, affecting nearly 12,000 people. Provider organisations have also been expressing concerns about the viability of many of their members. COVID-19 will of course exacerbate the pressures facing providers, particularly in care homes as occupancy rates fall. For instance, an August 2020 survey of 256 care homes by the National Care Association revealed occupancy levels of 81 per cent; this compares with 92 per cent in June last year. Further, research by Knight Frank suggests it is the smaller independent care homes (eg the 6,500 care homes with 40 or fewer beds) that are most at risk as they do not have the scale of larger operators to deal with reduced occupancy levels. Many smaller and sometimes less resilient providers offer the bespoke community-based support that government policy encourages because of the better outcomes it delivers for people.

- Unmet and under-met need: councils received 1.91 million requests for support from new clients in 2018/19, up from 1.84 million requests in 2017/18. In 2018/19 there were more than 8,000 more working-age adults receiving long-term support compared to 2015/16, although the number of older adults receiving long-term support over the same period has fallen by more than 40,000. Age UK estimates that there are 1.4 million older people who do not receive the help they need. This is a significant issue, with the LGA estimating that £6 billion will be required to address unmet need across all adult social care cohorts. Furthermore, this is not purely an issue of unmet need, but also under-met need. Again, this is notoriously difficult to measures but there are undoubtedly people who receive some support but not enough to fully meet the Care Act objective of ‘promoting wellbeing’. This of course increases pressure on unpaid carers and reduces social care’s ability to help mitigate demand pressures facing the NHS.

- Prevention: the aforementioned ADASS budget survey also shows that less than £1 in every £10 spent on adult social care is being spent on prevention. Given the important role prevention plays in increasing people’s independence, reducing the need for more costly care and achieving savings, this further highlights the reality that councils do not have the funding they need to meet all their statutory duties and are having to prioritise those people with the highest level of immediate needs. With appropriate funding, councils could invest in transforming adult social care with a focus on prevention, reablement, assistive technology and supported or adapted housing.

- Supporting the NHS: We support the NHS Long Term Plan strategy which highlights the importance of primary, community and mental health services. However, a recent report by the National Audit Office (NAO) on the financial management and sustainability of the NHS notes that ongoing pressures in social care provision presented challenges for NHS services in terms of efforts to reduce demand. The report also notes that, local NHS bodies remain concerned that without a long-term funding settlement for social care, it will be very difficult to deliver the objectives set out in the NHS Long Term Plan.

2.19 As more medium-term funding is made available, we need to engage with people who need support to understand how it can be used to help drive a more concerted effort to think differently about the way social care is provided, utilising innovative approaches such as micro-enterprises, the wide range of communities’ different assets, mutual aid, and innovative housing arrangements in supporting people, to name a few examples. These solutions feel more ‘human’ and, for many, preferable to some of the more traditional services on offer.

Long-term reform

2.20 Even in the most difficult and restrictive of circumstances, adult social care has been at the forefront of keeping people safe and well in different settings across the country. The huge range of activity across organisations to support people has also been notable for being an inherently local response, with councils playing an important leading and coordinating role. In this way, social care has also shown itself not as an inevitable end point on a journey toward a service or services, but as the way in which people are supported to continue their own personal journey in life. The extent to which social care is framed in this way in the weeks ahead will be an indicator of the scale of the Government’s reform ambitions.

2.21 The Government promised plans for such reforms in January and it appears these plans will be delayed again until next year. This is extremely disappointing, and we urge the Government to publish their plans at the earliest opportunity. As many commentators have said, the options for reform are – ultimately – limited and finite and include implementation of Part 2 of the Care Act. These Dilnot reforms would help tackle one dimension of the ‘fairness’ issue, but they do not deliver extra resources to meet unmet or under-met need or realise the legislation’s ambition on prevention.

2.22 Maximising the potential of the growing focus on care and support requires action on several fronts. Now more than ever, we need to recognise that the funding model for social care has held care – and therefore, people – back for too long.

2.23 Such considerations need to be part of the thinking about longer-term reform, the time for which must surely have now come. Everyone needs to be heard in that debate, particularly people with lived experience of care and support, and it cannot be defined within a narrow scope of protecting people from having to sell their home to pay for care. Of course, this is one important aspect of ‘fairness’ that sits at the heart of the debate about the future of care. But it is by no means the only one. Reform needs to consider the bigger picture and the role social care can and should play in helping to support individual and community resilience, wellbeing and independence.

2.24 Through our 2018 green paper, The lives we want to lead, and subsequent publications, the LGA has been making the case for meaningful and lasting reform.

2.25 Most recently, we developed a set of ‘principles for reform’ that more than thirty prominent national organisations acted as signatories to. We firmly believe that if the Government progresses its social care reform agenda in line with these principles, then we stand the best chance of securing the kind of social care system we need for the long-term.

- People first and the value of social care: Whatever emerges post-COVID-19 should be rooted in, and guided by, what works for people, not what works for systems or structures.

- The importance of ‘local’: Social care plays a key role in making connections in our local communities between a wide range of public, private, voluntary and community organisations that all work together in supporting people to be well, safe and independent. Links with housing are particularly important in supporting people to remain independent at home and in their community.

- Workforce: The future requirements of and for the social care workforce should be a far more prominent consideration for Government, both as a standalone priority and in respect of its links with NHS workforce planning. This should include a commitment to a new deal for the care workforce, comprising action on pay, training and development, career progression and professionalisation, and recognition.

- Providers and commissioning: Traditional services (such as residential care, domiciliary care and day centres) will continue to have a role to play in the future. But they need to be part of a much broader local offer including smaller, more bespoke providers, micro-enterprises and wider community assets such as community-owned care, mutual aid and shared lives.

- Health and integration: Health and social care are equally important and decisions and prioritisations about the future of each should reflect that.

- Care and support reform: Protecting a person from having to sell their home to pay for care is certainly one element of the ‘fairness debate’ at the heart of the question about long-term reform. But it is not the only one. The scope of and ambition for social care reform must be far greater, support adults of all ages including unpaid carers, and have at its heart a commitment to the Care Act wellbeing principle and improving people’s choice and control of the care and support they use to live their best life. Progress must be made quickly.

2.26 Any additional funding that is made available to social care, whether in the short or medium term, should not simply be used for ‘more of the same’ and the pre-COVID-19 status quo. Rather, it should be used to help us move to a more person-centred and preventative model of social care that is rooted in supporting people’s wellbeing in line with the Care Act and building resilience in our local public services and communities.

2.27 To enable this, the Government must provide funding that is sufficient to meet additional demands arising from COVID-19, plus pre-existing pressures and reform ambitions.

2.28 This should be made available with as few a set of conditions as possible. At the point of such funding being made available, the Government should indicate how it is intended to protect and enhance social care for the benefit of people who use services and to enable them to live the lives they want to lead in the future.

2.29 The additional funding required to deliver ambitious reform of adult social care is significant. Analysis by the LGA and other stakeholders, compiled as part of our work on the adult social care Green Paper, suggests that:

- Providing care for all older people that need it but currently

- Providing care for all people of working age who need it but currently do not receive it would cost an extra £1.9 billion by 2024/25 beyond meeting business as usual pressures;

- Implementing a care cost cap of £75,000 and an increased means test threshold (Dilnot Phase 2) would cost an extra £4.7 billion in 2024/25 beyond meeting business as usual pressures; and

- Implementing free personal care would cost an extra £6 billion in 2024/25 beyond meeting business as usual pressures.

2.30 This work has led us to previously call on the Government to make the case for increases in Income Tax and/or National Insurance and/or a social care premium. We have been clear that social care needs a risk pooling mechanism; a sharing of the burden amongst the whole population (on a means-tested basis for a degree of progressivity) to ensure nobody faces catastrophic costs, in which the definition of ‘catastrophic’ necessarily varies according to each person’s starting level of assets, with over 80 per cent of lead council members agreeing with the proposal.

2.31 We have also made it clear that building cross-party cooperation is an essential requirement for success. The following additional principles should underpin funding reform:

- Simplicity: is the proposed system clear and easy to understand?

- Transparency: are the costs of care, the raising of funding for those costs and the spending of that funding clear and transparent?

- Risk pooling: do the proposals pool financial risk among the population at large rather than costs being borne solely by individuals requiring care and support?

- Certainty and sustainability: do the proposals raise money for the short, medium and long term?

- Fairness: are the proposals likely to be considered fairer than current arrangements by the public (across a range of dimensions, such as for people who have saved all their lives, protecting housing assets, fairness between generations or fairness in terms of people’s ability to pay)?

- Social contract: would the proposals give the public a clear sense of rights and responsibilities? For example, would the public have a clear sense that, by contributing financially through taxes, charges or other measures, the return would be guaranteed access to services on clear, understood and fair terms?

Specific and specialist adult social care issues

Adult social care pay and conditions

2.32 The coronavirus pandemic has drawn attention to longstanding concerns about pay, terms and conditions in adult social care, especially in comparison with the NHS but also other labour-intensive sectors. There are on-going recruitment and retention problems highlighted in high vacancy and turnover rates that affect service quality. In addition, many staff have uncertain incomes because of the prevalence of zero-hours contracts. The temporary shifts in these patterns due to COVID-19 have highlighted the need to deal with them permanently.

- The estimated turnover rate of directly employed staff working in the adult social care sector was 30.8 per cent in 2019, equivalent to approximately 440,000 leavers over the year.

- It was estimated in 2019 that 7.8 per cent of the roles in adult social care are vacant, equal to approximately 122,000 vacancies at any time.

- In 2019 around a quarter of the workforce (24 per cent) were on a zero-hours contract (370,000 jobs). Almost half (43 per cent) of the domiciliary care workforce were on zero-hours contracts. This proportion was even higher for care workers in domiciliary care services (58 per cent).

2.33 The market-based system of commissioning and provision is well-established and will continue, but it is fragile, with many providers operating at the limits of financial viability, so there is little scope for improving pay and conditions with the current funding structure. In addition, the post-Brexit immigration system announcement has no transitional arrangements for social care and the health and care visa does not cover care workers so dependence on domestic labour will be accelerated and is likely to require higher pay.

2.34 The LGA has long argued that the social care workforce must be developed in a manner equivalent to the NHS as part of a stable, sustainable solution to long-term funding problems and that this must involve “parity of esteem” for social care staff with their NHS colleagues. Any changes to pay and reward must be fully funded by central Government as there is no resource in the sector to meet the demands of this challenge.

2.35 It will be important to assess the best form of comparison with the NHS on basic pay and resulting costs as overall costs could be in the region of £1 billion. It is also the case that some research and deliberation will be needed on coordination of other terms and conditions and the introduction of an effective mechanism for implementation and uprating. To achieve those aims with a reasonable degree of consensus across the sector, we suggest that the Government commission an independent review.

2.36 Notwithstanding this medium-term objective, which we believe could be resolved within the Comprehensive Spending Review term, more urgent attention should be paid to issues around sick pay and the costs of uniforms and DBS checks.

Payment of social care sleep-in shifts

2.37 Councils wholeheartedly support fair pay for care workers. Whatever the outcome of the Unison Appeal against the decision regarding treatment of sleep-in shifts under National Minimum Wage (NMW) regulations, there is a need to ensure that social care staff are paid fairly for their valuable work.

2.38 However, should the Supreme Court uphold the Unison Appeal, which would mean in many cases ‘sleep-in’ time would be subject to NMW regulations, and if providers reduce or cease to offer support as a result of the sleep-ins back-pay tipping them over the edge, there will be a significant impact on the care of vulnerable children and adults and the care workforce. For example, in 2018, one in 10 children’s homes reported being at risk of closure if they were required to cover six years of back pay.

2.39 Estimates suggest that the back-pay liability could amount to £400 million for the adult learning disability sector alone, which councils would struggle to help meet given the already-stretched financial position covered throughout this submission. To remove this uncertainty and risk to providers and councils, the Government should commit to fully funding social care providers and councils for the back pay liabilities and higher ongoing costs they will face from paying the NMW for sleep-in shifts if the Unison Appeal is upheld.

Investing in specialist and adapted housing

2.40 Housing is a key component of health and care and the foundation upon which people can achieve a positive quality of life.

2.41 COVID-19 has further highlighted the importance of people in vulnerable circumstances having a safe and accessible home with the right practical support and care to enable independent and healthy living.

2.42 We have identified the following priorities:

- To accelerate the availability of much-needed supported housing provision for working age adults with additional needs and older people who want to live independently with support, we are calling on government to work with Homes England, housing associations and developers to incentivise building more supported housing across all tenures.

- A sustainable supported housing funding model is needed to ensure that councils can reduce homelessness and help older and other vulnerable people to live well. This means that both the housing and care elements of the cost of supported housing must be adequately funded.

- We need to work together to develop and fully fund a locally-led approach to overseeing the quality and value for money of supported housing, building upon the forthcoming National Statement of Expectations for Supported Housing. Councils are ideally placed to take the lead role because of their wider housing, planning and care responsibilities, and their relationships with local housing associations and other supported housing providers.

- A further increase to the Disabled Facilities Grant would help councils adapt more of the existing housing stock to help older people and disabled adults and children to live independently in their own homes for longer, preventing further pressure on social care and health systems. It is important to focus on adapting and improving existing homes as well as new builds because, for example, over 90 per cent of older people live in mainstream homes and 80 per cent of the homes we will be living in by 2050 are already built.

Autism

2.43 The Government is currently updating the national Autism Strategy which we expect to launch later this year.

2.44 The revised Strategy will rightly centre on supporting people with autism to live ordinary lives in their communities, widening the focus beyond social care and health services. We fully support putting people with autism and their experiences at the heart of the strategy, which is something councils also try to do locally.

2.45 It is important that people with learning disabilities and/or autism can equally access their community safely, with access to opportunities and appropriate support. Particular attention should be given to people with a learning disability where they are at risk of being excluded and/or at risk of falling through gaps in wider community and public sector support. It is also important to recognise that people with learning disabilities and/or autism have a wide range of different needs across diverse communities.

2.46 People with learning disabilities and/or autism should be able to access personalised and joined-up support provided by an appropriately skilled workforce. A range of resourced local support services and a credible local social care, health and education offer are imperative.

2.47 The forthcoming Autism Strategy is an opportunity to further address these issues. The extension of the Strategy to children and young people is an opportunity to give greater focus to the challenges around transition from children’s to adult services.

2.48 However, the strategy needs to recognise that rising demand coupled with further improving diagnostic rates, will place more strain on already stretched budgets of local services, including councils.

2.49 We would like to work with Government on ensuring that the Comprehensive Spending Review includes a commitment to fully fund the ambition of the new Autism Strategy when it is launched. For people with the most complex needs, we would welcome a continued commitment to provide local areas with short-term funding that enables double running to establish robust community support and avoid specialist hospital admissions.

2.50 Councils, through Transforming Care Partnerships, have made progress to ensure that people with learning disabilities and/or autism who display behaviour that challenges and are referred to assessment and treatment centres can be discharged to more appropriate, community based services tailored to meet their needs and support their carers.

2.51 Appropriate community provision is vital to prevent admissions to hospital as well as supporting people to move out of hospital settings, and this requires social care to be fully funded and enough specialised supporting housing. Although numbers of people covered by the Transforming Care Programme are relatively small, they have complex and often multiple needs that require intensive health and care support, often including specialised housing.

Children’s services

Children’s social care

2.52 As the medium- and long-term impacts of the coronavirus pandemic become apparent, more children and their families are likely to need support. In our publication, A Child Centred Recovery, we highlight evidence around the likelihood of increased demand on children’s services as a result of the pandemic – including issues related to domestic abuse, mental health, poverty and substance misuse, the most common reasons for children and families needing help from children’s social care.

2.53 Some children and families will need significant interventions, including child protection plans or even coming into the care system. But for many, they will just need some extra help to get through a difficult period. That could be low level mental health support, sessions with a youth worker, understanding how to support children showing difficult behaviours, or working through parental conflict.

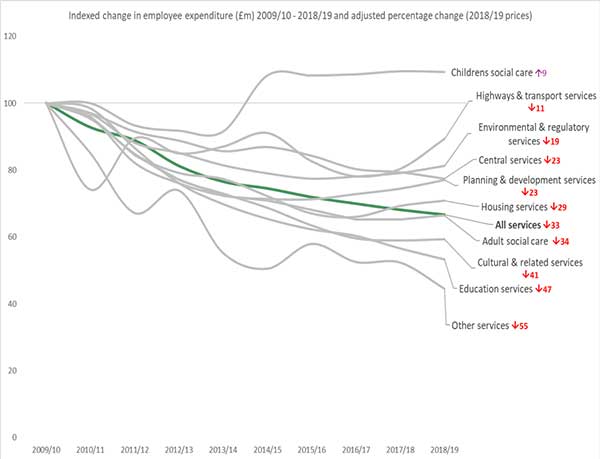

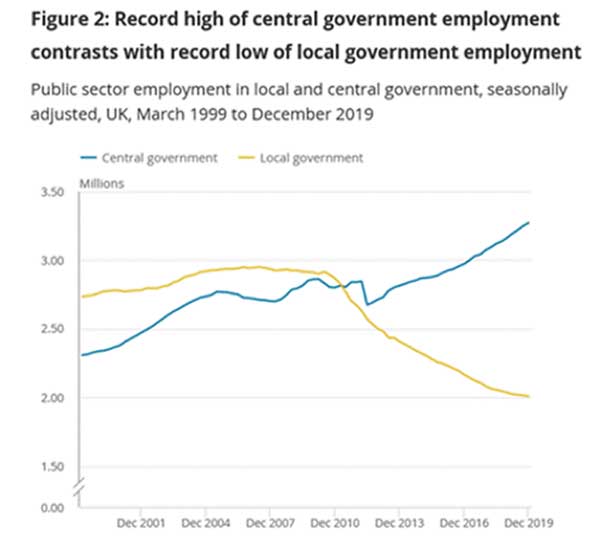

2.54 Unfortunately, the dual impact of significant cuts to council budgets over the last decade and increasing demand for child protection services prior to the pandemic means that these types of universal and early help services have been scaled back or even closed in many areas – despite councils protecting and even increasing children’s social care budgets at the expense of other services. Rising demand for services means that despite budgets for children’s social care rising by more than half a billion pounds in 2018/19 from the previous year, more than eight in 10 councils were still forced to overspend to ensure children were protected.

2.55 Research by the National Audit Office found that spending on preventative children’s services fell from 41 per cent of children’s services budgets in 2010/11 to just 25 per cent in 2017/18. There had been a corresponding rise in spend on child protection services, most notably for looked after children.

2.56 This rise in spend on supporting looked-after children is for a range of reasons. The number and proportion of children has been rising year on year for over a decade. In 2009/10, 64,470 children were in care, or 57 in every 100,000. In 2018/19, that figure was 78,150 or 65 in every 100,000.

2.57 The profile of children coming into care is also changing. The number of teenagers in care rose by 21 per cent between 2012/13 and 2017/18, while the number of 0-5 year olds fell by 15 per cent. The reasons for this are varied, but feedback from councils indicates that child exploitation (both criminal and sexual) and rising numbers of unaccompanied asylum-seeking children is contributing to the increase. Older children are more likely to need accommodation in children’s homes, which are significantly more expensive than foster care, which, in itself, puts additional pressure on children’s service budgets as councils strive to give young people the right care for their needs.

2.58 Councils also report that children requiring support from children’s social care have more complex needs than they did a decade ago, and so need more support to help them thrive. Reasons for this increasing complexity include success elsewhere. For example, impressive medical advances mean that more children are living for longer with complex conditions. We have a responsibility to make sure they get the help they need to live rewarding lives.

2.59 The proportion of young people in custody has plummeted thanks to the dedicated work of councils, the police and their partners. This is a hugely positive outcome for those

young people, but to make sure they remain out of the youth justice system and make good transitions to adulthood, some will need a lot of support from their local children’s services.

2.60 Councils urgently need funding to invest in the preventative services that their local children and families need, so that we can make sure help is available when it’s first needed – not later down the line when the situation has reached crisis point. Analysis by the Early Intervention Foundation found that a failure to intervene early to avoid preventable difficulties for children and young people costs the NHS £3.7 billion per year, and a further £2.7 billion per year for the Department for Work and Pensions (DWP).

2.61 There is clear evidence on the benefits of prevention and early help, including:

- The Troubled Families programme reduced the proportion of children in care and reduced juvenile custodial sentences and convictions;

- Greater coverage of Sure Start centres led to a fall in hospitalisations of children up to the age of 11, saving the NHS £5 million per cohort of children;

- Reducing the attainment gap between disadvantaged pupils and their peers across the country to the same size as in London would deliver an overall economic benefit of around £12 billion over the lifetimes of those young people.

2.62 This evidence highlights the value of early help in not only reducing demand on, and therefore generating savings for, other parts of the public sector, including the NHS and police, but in supporting the levelling-up agenda, giving young people the chance to fulfil their potential in the longer-term and live healthy, happy lives that also enable them to contribute to society as adults.

2.63 We are therefore calling on Government to provide additional funding which could be used to strengthen universal and early help services. The Early Intervention Grant, which covers a wide range of services including children’s centres, information and advice for young people, positive activities for young people, teenage pregnancy and substance misuse services, young offender and crime prevention services, respite care for families and disabled children and other family support services and early years and children’s social care workforce development has fallen from £2.8 billion in 2010/11 to £1.1 billion in 2018/19. Returning to 2010/11 funding levels by providing an extra £1.7 billion would enable councils to reinstate some of these lost services which help tackle and prevent emerging problems and avoid costs escalating later on.

2.64 Funding to meet increased demand for child protection and children in care services is also vital. This includes funding to support the approximately 200,000 children in kinship care, many of whom are outside of the formal system but have similar needs to looked-after children – yet in many cases receive considerably less support.

2.65 Councils have worked hard to protect and increase budgets to support the most vulnerable children, yet increasing demand means that budgets have been unable to keep up, forcing councils to make difficult decisions about where funding will be directed. Further pressure is placed on councils by local circumstances such as levels of deprivation - evidence shows that at least 71 per cent of variation in spending on children’s services is outside of a council’s control.

2.66 We have also seen increasing examples of councils working to support children with very complex needs and needing to spend significant sums to ensure those children are safe and well. Research by the Children’s Commissioner found that children with highly acute needs made up 0.1 per cent of all children supported but accounted for 7 per cent of all children’s services spending, with placements for some children costing in excess of £260,000 per year.

2.67 Councils and the Government have a responsibility to ensure children are safe and well, and wherever possible are able to live with their families. Without additional core funding, councils will find it increasingly difficult to achieve these aims.

Children’s homes

2.68 As outlined above, there is increasing need for children’s homes placements for children in care. This is particularly the case for children with complex or challenging needs, with councils unable to find suitable regulated placements for children resulting in increased use of unregulated placements.

2.69 At the time of writing, the outcome of the recent consultation on the use of unregulated settings was set to be published shortly, which we expect to introduce legislation to make unregulated placements for children under 16 illegal.

2.70 We made clear in our consultation response that unless sufficiency of placements is significantly improved, concerns around the suitability of placements for children and young people will not be addressed. This is particularly urgent given the potential for a rise in the number of children in care as the impact of the pandemic becomes clear.

2.71 Capital funding, particularly if delivered alongside additional core revenue funding, to support the development of new children’s homes would support councils and providers to meet this need. We encourage a focus for this new funding on the development of children’s homes by councils and smaller providers to ensure a breadth of choice when placing children and to help reverse the recent trend of children’s social care provision ownership being increasingly consolidated into a small number of providers without market oversight.

Early education and childcare

2.72 We know that good quality early education can make an enormous difference to children’s lives, including helping to reduce the ‘disadvantage gap’ in children’s education.

2.73 However, we have long raised the issue of funding for early entitlements being insufficient, impacting on the quality of provision and the availability of good support for children with special education needs and disabilities. While high quality provision supports children’s development, low quality produces no benefit or even negative effects and we know that low funding rates result in low pay for childcare workers. This is resulting in a recruitment and retention crisis in the sector, in particular for the well qualified staff who can make the biggest impact on children’s development.

2.74 This situation has been exacerbated by the pandemic. A combination of historic underfunding for early entitlements and the significant drop in parent paid fees as a result of the lockdown means that the financial sustainability of early years providers is a real concern for councils, with a third of providers in deprived areas fearing closure within a year.

2.75 Maintained nursery schools currently receive supplementary funding in recognition of the extra costs they face, for example the requirement to have qualified teachers. They both achieve the highest Ofsted ratings – 63 per cent are outstanding, compared to 20 per cent of all providers on the early years register – and support more children with Special Educational Needs and Disabilities (SEND) than other settings. They are also concentrated in disadvantaged areas which is contrary to the trend for good and outstanding provision to be more likely to be located in the least deprived areas. However, this funding is only guaranteed until the end of this financial year.

2.76 As we look towards recovery, we believe that funding rates for the early entitlements in all settings need to be significantly increased to enable the early years sector to reduce the disadvantage gap and allow all children the opportunity of the best possible start. We must recognise the success of maintained nursery schools and properly resource both these and private, voluntary and independent providers to appropriately pay the qualified staff needed to deliver high quality early education.

2.77 We are also calling for an immediate injection of funding for the early years sector to protect those most at risk of failure, to ensure that every child who wants a place can access one.

Special educational needs and disabilities

2.78 Councils urgently need additional support from the Government to meet the ever-increasing demand for support for children and young people with SEND.

2.79 Department for Education (DfE) figures show that

- there are now over 390,000 children and young people with an Education, Health and Care Plan (EHCP) in England, an increase of 10 per cent or 36,000 in the last 12 months alone;

- there were 53,900 children and young people allocated new EHCPs made during the 2019 calendar year, an increase of 10 per cent compared to 2018; and

- the number of new EHCPs has increased each year since their introduction in 2014.

2.80 This rise in demand in support will not be reversed unless the SEND system is reformed.

2.81 The increased scope of council responsibilities post-16 was the most commonly cited factor contributing to rising demand and costs for councils. Our research has found that the post-16 cohort now accounts for 23 per cent of EHCPs and around 17 per cent of spending. This is an area that will continue to grow as the successive cohorts move through the system.

2.82 Our research has also found that the number of children and young people permanently excluded from school has risen by 67 per cent between 2014 and 2018, although this figure has now stabilised. Once excluded, these pupils are funded by councils, not schools, putting further pressure on the high needs funding block.

2.83 Since 2018, more children with special needs are now being educated in settings other than mainstream schools. Alternative and non-mainstream settings are, by their very nature, more expensive than mainstream provision.

2.84 While only 6 per cent of children and young people with EHCPs are in independent and non-maintained special schools, our research found that these placements account for an average of approximately 14 per cent of expenditure.

2.85 Further research commissioned by the LGA has found that the percentage of councils that are overspending their home-to-school transport budgets has increased from 71 per cent to 83 per cent between 2014/15 and 2017/18. Increasing expenditure is being driven by the costs of providing transport for children with SEND, with expenditure on transport for children with SEND increasing by 13 per cent for pre-16 children and by 68 per cent for post-16. Transport for children and young people with SEND now accounts for 69 per cent of all home-to-school transport expenditure.

2.86 We are pleased that the DfE has recognised the challenges that councils are facing in delivering SEND support, with the allocation of an additional £780 million for high needs budgets in 2020/21, but it is vital that councils have long-term certainty over funding to support children with SEND, including a commitment to write off council’s existing high needs block deficits.

2.87 The Department’s ongoing review of SEND should set out how we can work collectively to increase levels of mainstream inclusion for SEND pupils and place fewer pupils in much more expensive independent and non-maintained special schools, as well as giving councils the powers to hold local partners to account for their work to support SEND children and young people.

Schools capital

2.88 Despite significant reforms to the education system that have reduced the role of councils, our members continue to have a unique responsibility to ensure that there are sufficient school places locally. However, they have few direct powers to create new school places and sometimes have to borrow to make good a shortfall in capital funding for new school buildings that they will not own.

2.89 To date, many new places have been created by expanding existing maintained primary schools, as this is the most cost-effective option. But, councils have no powers to open new maintained schools or to compel academies or free schools to expand to meet demand. As demand for additional places moves to the largely academised secondary sector, councils are concerned that they will not have the powers to meet their statutory duties.

2.90 We are calling on the Government to give councils the powers to open new maintained schools, where that is the local preference. In many areas, councils work closely with academies and free schools to create new places, but where this doesn’t happen, councils need backstop powers to force academies to expand to meet local demand.

2.91 The Government previously commissioned research looking at the effectiveness of the DfE’s capital investment, including spending on schools. This report found that the capital allocation process is complex, time-consuming, expensive and opaque. In most cases, decisions are not based on objective criteria which are consistently applied and do not succeed in targeting money efficiently to where it is needed.

2.92 The James review of education capital was published in 2011 and schools’ funding arrangements have become ever-more complex since then. The Government should look again at the findings of this review and specifically the recommendation that the capital allocation should be determined using objective information on need for pupil places and on the condition of the local estate. At a local level this notional budget should be turned into a light-touch local plan to achieve the overall goals of the investment.

2.93 More recently, in 2017 the National Audit Office found that there are seven main sources of capital funding for schools and that while councils have created a large number of new school places, they face challenges in continuing to meet demand for additional places on time.

2.94 To help councils meet their statutory duty to provide enough school places, we are calling on the Government to replace the existing, fragmented school’s capital funding arrangements with a single, locally held funding pot. Councils, working closely with schools, are ideally placed to hold this capital pot to quickly identify and allocate where funding is most needed.

Teachers’ pay

2.95 Local authorities need confidence that they will be adequately resourced, through the National Funding Formula, to meet the cost of 2021-24 pay awards for teachers.

2.96 In line with existing Government policy, the following pressures will need to be reflected in the schools funding settlement:

- An estimated 17 per cent increase in pay is needed over the next two years to meet the Government’s commitment of a £30,000 starting salary for teachers by 2022.

- Councils have not received any additional funding for pay awards for 3,666 Centrally Employed Teachers (CETs) for the last three years (2018 - 2020). This funding shortfall has contributed to a reduction of 234 CETs since last 2019. For example, CETs in maintained schools providing SEND and music services, require an estimated £4.6 million increase on the CET pay bill for local authorities for this year’s award alone.

2.97 The Teachers’ Pension employer contribution grant provides funding for the increase in the employer contribution rate from 16.48 per cent to 23.68 per cent from 1 September 2019. The grant values were not increased to take into account the 2019 and 2020 pay awards for teachers, this is a significant additional cost for schools. The grant also does not include funding for pay uplifts for teachers centrally employed by local authorities.

Unaccompanied asylum seeking children (UASC)

2.98 Councils have a strong track record in welcoming asylum-seeking children, working with central government, national partners and regional bodies. As well as volunteering to support children resettled in their area, councils also volunteer to support children and young people via the national transfer scheme.

2.99 The need to find sustainably funded long-term solutions has been thrown into sharp relief by the crisis in Kent over the summer. The number of unaccompanied asylum-seeking children reaching the Kent coast via small boats crossing the Channel has been increasing rapidly since the start of the pandemic. The council is struggling to find enough suitable accommodation while stretching the capacity of the workforce, having to take the emergency step of indicating that they were no longer able to support children safely.

2.100 We welcome the consultation on the future of the national transfer scheme to ensure there are sustainable solutions for the support of newly arrived children across the UK and some local authorities have offered support through the National Transfer Scheme.

2.101 However, many councils have continued to raise concerns that the main barrier to participation is the cost of supporting UASC and UASC care leavers. This is not fully covered by the Government, compounded by wider pressures on children services and overall local government funding.

2.102 The Government needs to fully fund the cost of supporting UASC and former UASC leaving care to ensure that local authorities are properly resourced to provide children and young people with the care and support they need. For example:

2.103 Funding has increased since both of these reports were published, but this has not been sufficient to meet the full challenge.

2.104 It is important to note that the ongoing challenges faced by councils in ensuring that the needs of children can be met are not just linked to the grant funding, but also relate to access to therapeutic services, places to learn English, legal advice, and translation services, as well as an effective age assessment, decision making process and sharing the risks around legal challenge.

2.105 We need a conversation across government and with other partners on ensuring access and funding for these and on meeting the true cost of councils’ statutory responsibilities for this group.

Youth justice

2.106 Council youth offending teams (YOTs), the police and their partners have an outstanding track record of working with young people to avoid them coming into the youth justice system. There has been an 85 per cent drop in the number of first-time entrants to the youth justice system over the last decade, and an 83 per cent decrease in the number of children receiving cautions or sentences over the same time.

2.107 However, over that period, the youth justice grant has been cut by half and there is a concern that these reductions are now threatening those successes. For example, Ministry of Justice figures reveal rises in robbery offences by young people over the last two years following long-term falls. It is vital that the grant remains at least at its current level in real terms to ensure youth offending teams can give young offenders the dedicated help they need, while allowing them to continue with the positive work that has delivered substantial reductions in youth crime to date.

2.108 This will be even more important as we recover from the pandemic. Young people who are not in education, employment or training (NEET) or whose families lose work may look to crime to pay the bills, while the Youth Violence Commission has raised concerns about the potential impact of the pandemic on levels of serious violence as a result of poverty, family insecurity and inequality. Properly resourcing YOTs, youth services and children’s social care will help councils to work with young people and families early.

Youth services

2.109 Qualified youth workers and their colleagues across the youth sector will have vital roles to play in the recovery from the coronavirus pandemic, provided they are adequately resourced. Youth services give young people safe spaces to go and trusted relationships with adults that can be the difference between being supported to make positive choices (including knowing where to go for help when it’s needed) and being drawn into negative situations.

2.110 Youth workers will have a particular role to play in supporting young people with the return to school and helping those young people who struggle to find employment. With young people more likely to experience difficulties in finding employment as the country recovers from the pandemic, supporting them to pursue positive paths through this difficult time will be key to avoiding negative outcomes such as long-term unemployment, mental and physical health difficulties or criminal activity further down the line.

2.111 The National Citizen Service (NCS) receives significant central government funding, totalling £1.26 billion between 2016-2020 despite offering only 2-4 weeks of activity for 16-17 year olds. The programme also achieves low participation rates, with 12 per cent of eligible young people took part in 2016. Participation fell for the first time in 2019.

2.112 While we recognise the value of the programme for those who take part and are keen for the NCS to still be available to young people who want to take part, this time-limited programme cannot replace year-round provision for young people of all ages.

2.113 We therefore encourage the Government to devolve some of the funding for the NCS programme to councils to enable them to deliver or commission the services that local young people want and need.

Tackling COVID-19 through local public health systems

2.115 Public health has been at the heart of the local response to COVID-19. Directors of Public Health and their teams have effectively led and coordinated the local health protection response, whilst keeping vital health improvement services such as drug and alcohol and sexual health services running with limited resources. The Comprehensive Spending Review should be used to strengthen local capacity and resources and ensure public health teams can continue to manage local outbreaks effectively and provide the vital public health services which support communities to be healthy and protect the NHS.

Health protection and infection control

2.116 COVID-19 is best understood as a pattern of local outbreaks, rather than a national pandemic with a similar impact in every community. As we move into the next phase, it is important that councils have the capacity and necessary data to play their full part in the national programme, so they can understand where the outbreaks are happening and be able to act quickly to contain them.

2.117 Environmental health, emergency planners, trading standards and public health are just some of the council services whose expertise and experience are crucial to help stop the spread of coronavirus.

2.118 The national arrangements to track and trace coronavirus need to be complemented by making use of existing local knowledge and skills on the ground and the system needs further investment to ensure capacity and resilience in local outbreak control. As the Secretary of State for Health and Social Care said of Directors of Public Health, their local insight and intelligence is a mission-critical part of our response.

2.119 The Government should use this opportunity to ensure the National Institute for Health Protection has the local expertise and resource to ensure their success. This resource is best embedded in local authorities, who have the detailed knowledge of local systems and partners.

2.120 The Government should also use this opportunity to transfer oversight and coordination for local immunisation programmes to Directors of Public Health. Local authority public health teams already have access to community level data on hard to reach areas and can use a wide range of commissioned services and community contacts (such as health visitors, school nurses, drug and alcohol services) to reach the most vulnerable and improve vaccination rates.

Local outbreak control funding

2.121 The NHS Test and Trace Business Plan outlines plans for service development and priorities for the remainder of 2020 with an ambition to support local councils to refine and improve their local outbreak control plans and ensure they have the capacity and capability to implement those plans.

2.122 In this context we believe there is strong case for additional funding both to distribute to councils experiencing outbreaks and to help others put effective prevention in place. This would include costs related to outreach, communications, community anchors, testing site costs, using local laboratories, as well as financial support to enterprises and individuals affected by outbreaks etc.

2.123 We need additional efforts to ensure the national and local partnership for test and trace works effectively – with a focus on the capacity & capability of local expertise that uses council knowledge and the experience of public health teams. This would benefit from an enhanced sector-led improvement programme of support, building on existing cross-sector working and LGA programmes.

A new strategy for local public health

2.124 Every pound invested by Government in council-run services such as public health is helping to relieve pressure on other services like the NHS and the criminal justice system. Just as pressures exist within NHS and social care, pressures are mounting within statutory public health services. Analysis shows that local authority public health funding is three to four times more cost-effective in improving health outcomes than money spent in the NHS.

2.125 The pandemic has shown that investing more in prevention would have led to better outcomes. There is clear evidence that some groups have been disproportionately affected by the virus, with obesity, poor mental health, socio-economic status and ethnicity and disability all increasing the likelihood of COVID-19 being fatal. This is extremely worrying and underlines the need for a strong Government commitment to tackling health inequalities and the need for more council resources and flexibilities to tackle the underlying economic and social causes of ill-health and premature death.

2.126 Public Health England (PHE) found that people from some black, Asian and minority ethnic (BAME) groups are at a significantly higher risk from COVID-19. The Office for National Statistics (ONS) have highlighted the link between the COVID-19 death rate and deprived communities. The Institute for Fiscal Studies (IFS) has reported that evidence is already emerging that the economic repercussions of the crisis are falling disproportionately on young workers, low-income families and women. In order to deliver a robust recovery that reaches everyone, we need to acknowledge and respond to these inequalities.

2.127 Building cohesive communities is a vital part of councils work over the coming weeks. The social impact of the pandemic and the Black Lives Matter movement have shown us the need for councils to build communities where everyone feels valued and equal. Councils must be given the backing and tools to do this – to ensure that everyone can lead a healthy, safe and productive life supported by their community.

2.128 Health should be recognised as an essential part of the economic recovery and vice versa. The LGA report Nobody Left Behind: maximising the health benefits of an inclusive local economy makes clear the link between health and the local economy. The Treasury should lead from the front and hold departments to account for showing the preventative and health implications of their spending plans.

2.129 The following are just some examples showing the need for, and effectiveness of, investing in public health and prevention services.

Reducing the harms of substance misuse

2.130 The number of deaths from drug misuse registered in 2018 increased by 16 per cent to 2,670. This is at the highest level ever.

2.131 The combined benefits of drug and alcohol treatment amount to £2.4 billion every year, resulting in savings in areas such as crime, health and social care.

2.132 According to the National Institute for Clinical Excellence, every £1 spent on smoking cessation saves £10 in future health care costs and health gains.

2.133 With a possible sudden increase in free time, uncertainty, anxiety and stress, we know that some people may become more dependent on drugs and alcohol. This, for some, can tip the scales from managed and recreational use into problematic use and addiction. People with substance misuse problems are disproportionately affected by poor health, including illnesses that would categorise them as ‘extremely clinically vulnerable’, as well as a range of other disadvantages – including homelessness – that may put them at increased risk of contracting and being adversely affected by COVID-19.

2.134 In the longer-term, local authorities are fully committed to work to reduce the harm caused by alcohol and drug misuse but continue to face significant funding challenges which have impacted on their work, both directly and indirectly, to support people accessing drug and alcohol treatment.

2.135 Councils have indicated a desire to maintain and accelerate the recovery focus of drug treatment, particularly for opiate users, but also want to address emerging issues such as new psychoactive substances, (eg legal highs) and addiction to medicines. There is an ambition for closer links with sexual health, criminal justice, and housing and youth services and of integration with family focused initiatives, closer links with GPs, improved coordination on domestic violence, and a strong and consistent link to sexual health – teenage conception and sexually transmitted diseases.

2.136 Commissioning workforces in local authority public health teams have been hit by major reductions in funding which has shrunk the workforce and led to specialist substance use commissioners spreading their time and energy across the whole range of public health, and conversely brought those from other areas of public health into substance use.

Improving sexual health

2.137 Latest figures released by PHE show there were 3,561,548 attendances at sexual health clinics in England in 2018, up 21 per cent on the 2,940,779 attendances in 2013, with no additional funding to support increase in demand and treatment.

2.138 Sexual health, reproductive health and HIV services are facing major disruption due to the impact of COVID-19 and are having to make unprecedented service provision decisions, including temporarily suspending many ‘business as usual’ functions. Sexual health providers are operating phone consultations, posting contraception, sending screening tests and medication to people's homes when needed and seeing patients face to face where necessary.

2.139 Public health teams are very aware to the possibility of serious adverse sexual health, reproductive health and HIV outcomes for the general population, including a rise in unplanned pregnancies, sexually transmitted infections and abortions. With reduced access to essential services, this is already putting considerable additional pressure on primary care and other emergency settings who do not have the capacity or expertise to efficiently manage those presenting with sexual, reproductive health and HIV needs.

Reducing obesity

2.140 The number of people with Type 2 diabetes is expected to increase by a million – from just under four million people in 2017 to almost five million in 2035.

2.141 Research shows that the yearly cost of council funded community-based social care for a severely obese person is nearly double the cost of a person with a healthy BMI, which equates to an extra £423,000 in annual excess social care costs for a typical council. Further research shows that obese people are 25 per cent more likely to be using some form of long-term care in two years’ time, than those with a healthy BMI.

2.142 Tackling obesity through prevention, early intervention and provision of appropriate social care will improve people’s health and wellbeing, pre-empt future health and social care issues, promote independence and reduce the pressures on social care and the NHS and narrow health inequalities.

2.143 Since taking on this responsibility, councils have worked hard to increase participation rates and nearly 1.2 million children were weighed in 2018/19.

Giving children a better start

2.144 Workforce modelling is needed to account for the predicted increased demand for health visiting services (including, additional advice being requested due to the difficulties in accessing GP advice, supporting vulnerable families, domestic violence and abuse, safeguarding and mental health conditions).

2.145 In addition to catching up on routine Healthy Child Programme contacts, we expect to see a surge in activity and demand for support. This will be particularly notable as children return to schools and nurseries and look to support from public health services around infection control.

2.146 Routine childhood immunisation programmes will also need a rigorous and extensive catch up schedule which will require oversight and resources from the Healthy Child Programme teams.

Our four-sided strategy for local public health

2.147 We need to invest in the ongoing resilience of our communities with an assets-based approach which invests in the strengths and capabilities which already exist. Councils need the resources to work in partnership with their VCS to provide low-level support to improve health, wellbeing, participation and resilience. Community resilience and support has been vital in addressing the crisis, but it will also be vital in delivering a meaningful recovery. If public health at a local level is given the parity of esteem it deserves, health inequalities could be levelled, and prevention put at the centre of our future approach.

2.148 We are calling on the Government to work with us to deliver a four-sided strategy to strengthen public health services:

- Sustainable core funding. We know that one thing that marked England out as COVID-19 hit was our poor public health including our high rates of inequalities, of smoking, and of overweight people and obesity. Whilst the pandemic makes it vitally important that prevention is not sidelined, it should be given prominence at all times, with 40 per cent of avoidable deaths as a result of tobacco, obesity, inactivity and alcohol harm. Increases in the public health grant are vital to improve these characteristics.

- Investing in transformation. In order to arm our population against this virus, we will need to turbocharge public health programmes that can reverse chronic conditions such as type 2 diabetes. The Government should work with councils to introduce a new Prevention Transformation Fund, underpinned by a sector-led transformation programme, to help deliver on this shared ambition.

- Strengthening local leadership through devolution. Local authority directors of public health have demonstrated the value of local public health teams being able to respond effectively to the pandemic based on a detailed understanding of their community. As the Secretary of State for Health and Social Care, Matt Hancock said on 18 August, local directors of public health and their teams are the unsung heroes of health protection. ‘Local by default’ is now the approach to addressing public health in the COVID-era. A sector-led transformation programme that can address the issues of obesity, drugs and alcohol abuse, sexual health, 0-19 years and the NHS health check is the best way to sustain this change. It would additionally provide public health transformation assurance.

- Rewiring behavioural incentives and raising revenue. Levies on alcohol, smoking and sugary products can discourage consumption of harmful products while also raising income to help fund other proposals set out in the strategy.

Table 2.1. Details of the four-sided local public health strategy

Sustainable core funding. To match the growth in overall NHS funding as part of the Long Term Plan, the public health grant would have to increase to at least £3.9 billion by 2024/25.

This would allow councils to not only continue to provide current services, but consider expanding other initiatives where financially possible and locally desirable, such as the following:

|

Proposal

|

Details

|

|

A School Nurse for every school

|

School nurses reduce childhood obesity, under 18 conception rates, prevalence of chlamydia, support mental health and can also advise on infection control and support immunisation uptake.

Every state secondary school and its cluster of primary schools should have a qualified school nurse with specialist knowledge to provide support around infection control, keeping vulnerable children safe, sexual health, emotional wellbeing, healthy eating and lifestyles.

(estimated cost = £106 million)

|

|

Expand Health Visiting Workforce

|

To return to the target numbers originally set as good practice caseloads in the Health Visiting Implementation plan, an additional 3,000 FTE health visitors would be needed.

(estimated cost - £90 million)

|

|

Perinatal Mental Health Specialists

|

In 2016 Health Education England (HEE) recommended that every woman should have access to a specialist health visitor in perinatal and infant mental health.

(estimated cost for every council to have a full-time specialist health visitor in perinatal mental health (1 year) - £5.5 million)

|

|

Investment in Nursing CPD

|

In the 2019 Spending Round the Government announced a 3.4 per cent increase in the HEE budget which included an additional £210 million for Continuing Professional Development (CPD) for nurses. HEE has responsibility for development of the public health nursing workforce, however the funding was not made available to this core part of the workforce and undermined the Government’s commitment to integration and prevention in its recent Green Paper and the NHS Long Term Plan.

CPD budgets should be open to all nurses, including specialist community and public health nurses, social care and immunisations nurses. Funding should also be accessible regardless of whether the nurse is directly employed by the NHS, local authority by social and private enterprises.

|

|

Family Hubs

|

The Government should work with local authorities to explore the development of health visitors, early years workers and school staff operating out of "children and family hubs” based in or next to schools.

|

|

Shared Outcomes Fund

|

Dedicated funding to support drug and alcohol services through a Shared Outcomes Fund. Local government has repeatedly argued that reductions in the public health budget only prove counterproductive to both the public purse and health outcomes.

|

|

The Local Government Healthy Weight Programme

|

It is widely acknowledged that we need to develop a whole-system approach to reducing child and adult obesity and built on the premise that a healthy life is the responsibility of all of us, schools, neighbourhoods, health professionals, planners, legislators, the food industry and others. Develop a well-funded programme of activity that coordinates action effectively

|

|

A rescue package for leisure providers

|

Funding to ensure leisure facilities stay open to all communities and recognises their role in the fight against obesity, inactivity and poor mental health, which in turn will help to save the NHS being overburdened in the future.

|

|

Active Communities Programme

|

A programme that aims to encourage designers and urban planners to create spaces that encourage physical activity (drawing on the Active Design Guidelines developed in New York City and Amsterdam). The programme should bring examples of healthy planning together, to serve as a source of inspiration and to articulate the principles underpinning healthy planning. Particularly targeted at specific neighbourhoods with the highest levels of need and deprivation.

|

|

Investing in transformation

|

|

Prevention Transformation Fund

|

Evidence shows that additional funding for prevention could be highly cost-effective. Local authorities are telling us that they have gone to heroic lengths to deliver more with less and less, but they cannot make the radical upgrade in prevention services asked of them without additional dedicated funding to allow them to make a step change in the types of services they provide and how they provide them. This work stream will advocate for the double-running of new investment in prevention services, alongside current services that public health teams across the country already provide.

|

|

Sector-led improvement

|

The Prevention Fund should be underpinned and driven by a funded LGA-led transformation programme to strengthen local public health services and address health inequalities with an emphasis on obesity, drugs and alcohol abuse, sexual health, 0-19 years and the NHS health check and providing assurance across local public health. It could be used to improve digital delivery and modernise services e.g. to expand home testing and web-based delivery in sexual health and contraception services.

|

|

Strengthening local leadership through devolution

|

|

Wellbeing in the round – Spending Principle

|

As part of its Spending Review, the Government should consider wellbeing in the round, recognising the contribution of different council services and those coordinated by other public sector and voluntary organisations that councils commission.

|

|

Section 7a public health services

|

The Government should enable joint commissioning of section 7a public health services and to consider devolving responsibilities to local authorities.

|

|

Healthy Communities Fund

|

Our towns, cities and local communities are playing a growing role in population health improvement and have enormous potential to be health-generating places. Improving population health depends on coordinated action at multiple levels and ensuring that decisions in areas such as housing, employment and transport planning all have a positive impact on health. Community wide co-ordination requires effective leadership, robust governance, and adequate investment.

Additional funding to support healthy communities could include citizen challenges such as that launched by Oklahoma City Mayor Mick Cornett in 2007, for Oklahoma to lose a million pounds in weight together. Less than five years later, the city had accomplished that goal and moved from the list of America’s fattest cities to the list of its fittest cities. The mayor’s program fostered grassroots involvement with people talking about it in schools, workplaces, churches and in the community. An adequately funded nationwide challenge to cities and towns could easily be replicated and create a degree of healthy competition.

|

|